Contact us, preferably today rather than tomorrow, so we can have a good confidential discussion about the future of your company.

Who are we?

Vital Invest A/S is a family-owned investment company that makes long-term investments in smaller businesses. The company name is inspired by the word "vitalize," which means to animate or make vigorous. This explains our purpose. Vital Invest A/S is independent of banks and other financial actors that need to be catered to or considered. The ambition is to be an alternative to banks, business angels, and capital funds.We differentiate ourselves from other actors by being privately owned. It's our own money being invested, and thus, we have "a hand on the stove." The capital is created by building several companies - subsequently selling them with a reasonable profit. Hence, we understand business operations from within and comprehend that there are limited resources in everyday life. Day-to-day operations are crucial and need attention. However, the overall growth plan is also important, and we can help develop and ensure progress.

Similar to the owner-manager, we are passionate individuals who understand that the heart beats for the company and its employees. We understand that many emotions are involved and have thus developed a unique initiation process that allows the company owner and Vital Invest A/S to get to know each other well before any agreement to initiate a partnership.

We do not work with preconceived notions of right or wrong investments. Each company is assessed on its own terms, and good business practices prevail. When you collaborate with us, it's not an examination. We are equal partners who together create future value based on mutual trust - and that a word is a word.

Reinert Group A/S is a family-owned investment company involved in real estate investment, property concept development, and investments in and building of companies.

The founder of Reinert Group - manufacturer Joen Reinert has been active in business since the late 1960s and has an impressive track record in real estate trading and starting up and developing businesses. Buying and selling of businesses

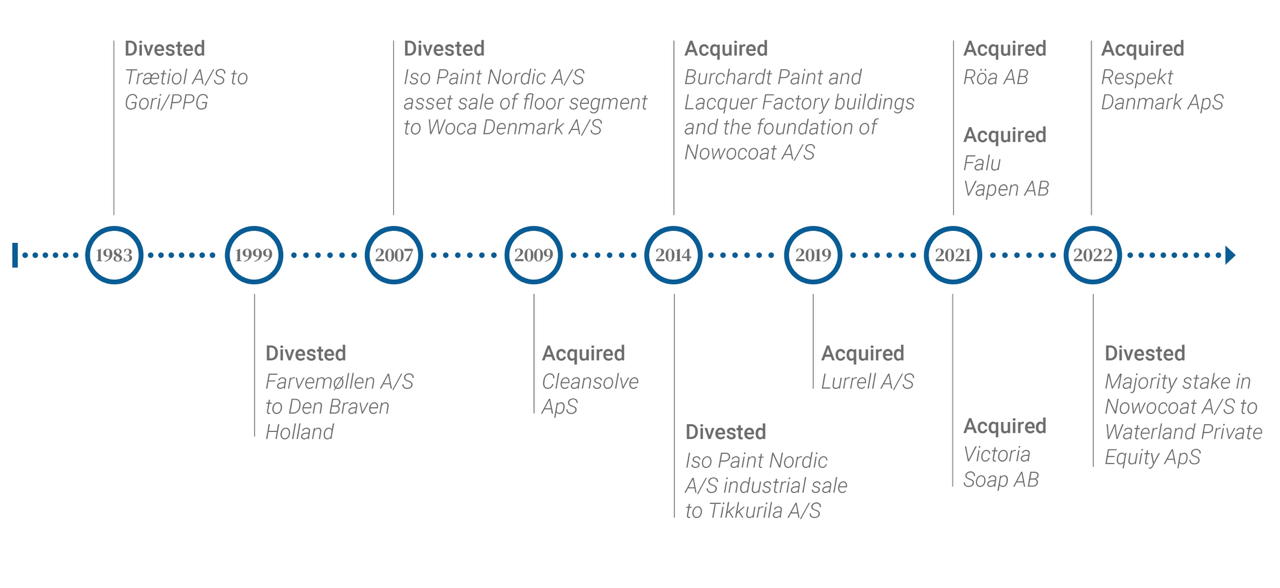

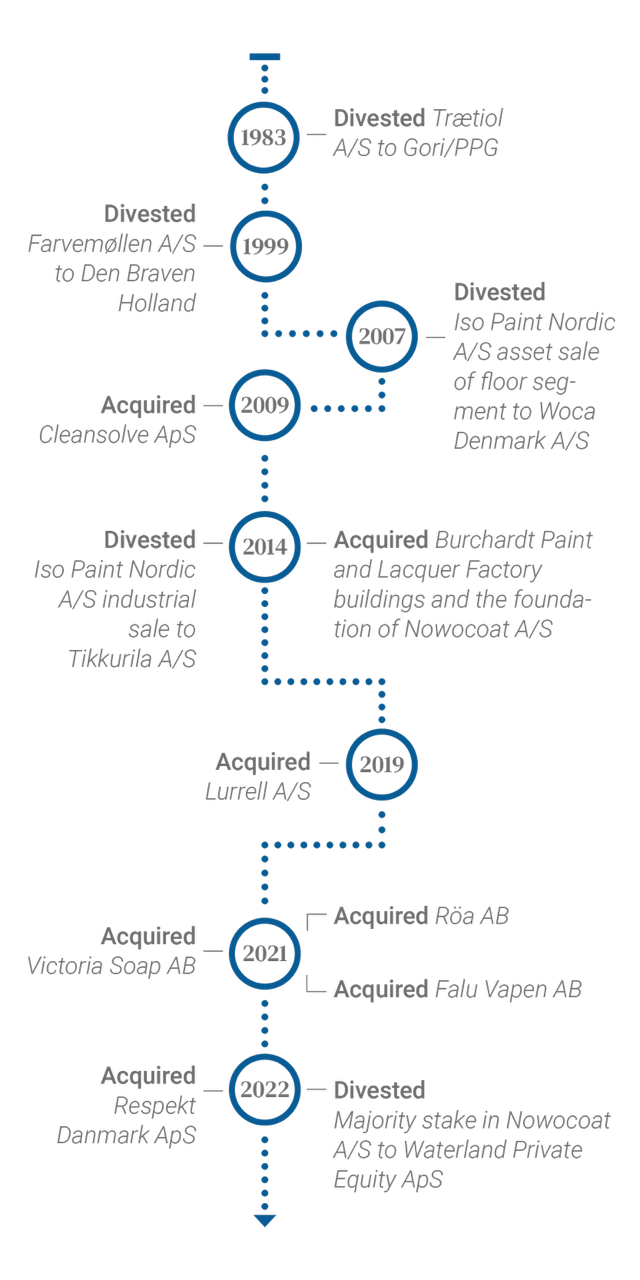

Merge and acquisitions timeline

Who are we?

Vital Invest A/S is a family-owned investment company that makes long-term investments in smaller businesses. The company name is inspired by the word "vitalize," which means to animate or make vigorous. This explains our purpose. Vital Invest A/S is independent of banks and other financial actors that need to be catered to or considered. The ambition is to be an alternative to banks, business angels, and capital funds.We differentiate ourselves from other actors by being privately owned. It's our own money being invested, and thus, we have "a hand on the stove." The capital is created by building several companies - subsequently selling them with a reasonable profit. Hence, we understand business operations from within and comprehend that there are limited resources in everyday life. Day-to-day operations are crucial and need attention. However, the overall growth plan is also important, and we can help develop and ensure progress.

Similar to the owner-manager, we are passionate individuals who understand that the heart beats for the company and its employees. We understand that many emotions are involved and have thus developed a unique initiation process that allows the company owner and Vital Invest A/S to get to know each other well before any agreement to initiate a partnership.

We do not work with preconceived notions of right or wrong investments. Each company is assessed on its own terms, and good business practices prevail. When you collaborate with us, it's not an examination. We are equal partners who together create future value based on mutual trust - and that a word is a word.

Reinert Group A/S is a family-owned investment company involved in real estate investment, property concept development, and investments in and building of companies.

The founder of Reinert Group - manufacturer Joen Reinert has been active in business since the late 1960s and has an impressive track record in real estate trading and starting up and developing businesses. Buying and selling of businesses

Merge and acquisitions timeline

Nina Reinert

What do we want?

Development

We want to help smaller businesses evolve and grow. From our experience, there is a significant demand among owners of smaller companies for risk capital combined with the provision of resources and experience.

Investment

We invest in good, well-run companies that can eventually be developed into even larger and more successful ones. With a combination of our own experiences and capital, we will assist carefully selected companies in investing in growth-promoting activities, conducting acquisitions, strengthening solvency, or potentially executing a planned generational change. The funds we provide should be used to strengthen the existing business.Management

We primarily invest in companies with established management and organization as well as positive earnings and growth potential. The annual turnover may preferably have exceeded EUR 1,5 million, but we will assess each investment opportunity individually, and the potential for future growth will weigh heavily.Ownership Share

Vital Invest A/S’s ownership share will typically be 10% and above. We are flexible regarding ownership distribution, as it is something we discuss and tailor on a case-by-case basis. It is important for us that the company owner and the daily management are motivated through ownership, so that we are “in the same boat” in that manner. A collaboration with Vital Invest A/S is built on mutual respect and good business practice. Vital Invest A/S primarily makes capital increase investments, where the investment funds are used for growth-promoting activities.What do we offer?

Risk capital to:- Be able to invest in growth-promoting activities – acquisitions, etc.

- Improve solvency

- Carry out a generational change / MBI / MBO

- Implement a turnaround

- Allow the owner-manager to share risks with an equal financial partner

Help to be revitalized in areas such as:

- New strategy. New perspectives on the company

- New focus areas. Internationally?

- New energy. The owner might be stuck in everyday life.

- New culture (growth culture instead of operational culture)

- Mentoring in an equal and sincere manner that can help create growth

- Preparing the company for sale (sales readiness)

We aim to improve and revitalize. It is our specialty to increase the earnings and turnover of smaller companies. We have done it before. And that is precisely why we always meet our partners with respect and humility. We respect the network of subcontractors and advisors that have been built around the company over the years. We don't come to change things just for the sake of it. We seek improvement before change.

All with the aim of allowing the owner-manager to engage in what interests him most in the company.

Perhaps the company has a professional board maybe not. The most important thing is that we agree on which competencies might be useful to have on the board.

Before initiating any collaboration, we focus on thoroughly aligning expectations with each other. We jointly develop a thorough situation analysis and define a few important focus areas. We also spend time agreeing on what needs to be done after we become partners. This ensures that we agree on who does what, when, how, and why – after the collaboration is established.

To ensure focus and success with our joint project, we meet as needed - but as a starting point, at least once a month. If desired, external resources with relevant skills can be associated with ongoing mentoring with the management team.

Let us help your business to develop and create growth.

How do we differentiate ourselves?

Unlike well-known capital funds, we have chosen to focus on collaborating with smaller companies.

We have documented experience in strengthening smaller companies and helping them grow.

Unlike capital funds, we do not have a strategy for when or how we exit the investment. Ownership typically lasts longer than the three to five years that are often the norm.

Overall, we differ from other business angels and capital funds in four key points:

Experience

Our investment team consists of a unique combination of experience and skills. We are experienced entrepreneurs who have been involved in building and selling several businesses.

We understand business operations from within and comprehend the limitations of resources in everyday life. Day-to-day operations need attention too.

Unique start-up process

We understand that many emotions are involved. Therefore, we have developed a unique start-up process that allows the business owner and Vital Invest A/S to get to know each other before any agreement to become business partners. Together, we align on the company’s starting point – and which growth opportunities are most important to pursue.Passion

Our way of being. We are passionate individuals just like the business owner. We understand that the heart beats for the company and its loyal employees. We contribute with energy, joy, and a strong desire for an equitable partnership.

Private ownership

Vital Invest A/S is privately owned. The company’s owners have themselves built several companies and subsequently sold them with reasonable profits. We invest our own money and therefore have a hands-on approach.

Nina Reinert

Portfolio

Respekt Danmark ApS

| CVR #: | 36047720 |

| Website: | respektdanmark.dk |

| Business Area: | One of the leading manufacturers in the Nordic region of detergents, cleaning products, dishwashing liquids, and personal care items. |

| Established: | 1964 |

Victoria Soap A/B

Helsingborg, Sveden

| Website: | www.victoriasoap.se |

| Business Area: | Soap factory with a new modern production lines, specializing in sustainable solid soaps for prominent B2B clients. |

| Established: | 1905 |

Nowocoat Industrial A/S

| CVR #: | 25067282 |

| Website: | nowocoat.dk |

| Business Area: | Nowocoat A/S is an innovative and modern paint and lacquer factory that delivers innovative, functional, and durable coatings for industrial, production, and professional use. |

| Established: | 2014 |

Estate Partners

| CVR #: | 36507985 |

| Website: | estatepartners.dk |

| Business Area: | Development and operation of residential and commercial lease. |

| Established: | 2014 |

Best Food Group

| CVR #: | |

| Website: | godakaket.se |

| Business Area: | Modern factory that produces and developes kebab for wholesale and retail in Europe. |

| Established: | 2021 |

The Team

We are very commercial. We spot opportunities in the market and understand how to create and maintain a focus on customer needs.

Our common characteristic is that we are action oriented. We understand the value of creating a concise and easily understandable action plan and then sticking to it.

Execution is the major difference between whether things succeed or not.

For us, the company and ambitions come first.

When we get into the deeper numerical exercises, our auditor Jørn Dam from the auditing firm Martinsen becomes part of the team.

Additionally, we have a close collaboration with the law firm DLA Piper.

Contact us, preferably today rather than tomorrow, so we can have a good confidential discussion about the future of your company.

We look forward to hearing from you. Feel free to call us confidentially at +45 42 44 00 33 or write to nr@vitalinvest.dk